Account holders can opt for which investments (typically mutual money) they intend to make. How those investments perform decides just how much the account price grows over time.

You aren't necessary to alter plans to vary beneficiaries. You might transfer the strategy to a different loved one, who's described as one among the subsequent:

There are actually exceptions to The ten% penalty—As an illustration, In case the beneficiary receives a scholarship or attends a US military academy. Any earnings would however be subject matter to federal income tax and any state and native taxes.

With private college student loans, APR is a vital issue to take into consideration when evaluating loan delivers from diverse lenders. The APR can differ based on the lender, loan term, repayment strategy, as well as other factors.

Should you file for personal bankruptcy, you may still be required to pay back this loan. See To learn more.

Additionally, you spend a federal refund penalty, besides in the situation of a student’s Dying or disability or if they get a scholarship.

Any time a borrower has very good credit history and might qualify for just a lower desire level on A personal loan than over a federal loan

Anybody can open up a 529 account, but dad and mom or grandparents usually build them on behalf click here of a youngster or grandchild, the account's beneficiary. In some states, the one that money the account may be suitable for any state tax deduction for his or her contributions.

The newest content articles and recommendations that can help dad and mom continue to be heading in the right direction with preserving and shelling out for college, sent to your inbox every single 7 days.

Shifting has no impact on your 529 strategy. You retain contributing to that strategy, Until you select to vary programs for other explanations.

one All charges involve the auto-shell out lower price. The 0.25% automobile-fork out desire price reduction applies assuming that a sound banking account is designated for needed regular monthly payments. If a payment is returned, you can shed this reward. Variable premiums may improve right after consummation.

Be clever regarding your fund possibilities, as well; The present tax legislation allows an account holder limited solutions to change their financial commitment choices–twice a year or after you change the beneficiary.

Some grandparents think about using Roth IRAs to fund instruction (since Roth withdrawals are tax-totally free and you may generally rely on them for something in retirement). Although a Roth is quite flexible and tax-effective, making use of retirement funds for education can compromise your retirement security.

It's also possible to transfer unused funds into a Roth IRA if your account fulfills the mandatory requirements. And finally, you can often withdraw The cash, although you may be subject matter to taxes along with a 10% penalty about the earnings percentage of the withdrawal.

Tony Danza Then & Now!

Tony Danza Then & Now! Bradley Pierce Then & Now!

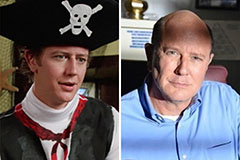

Bradley Pierce Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!